The goal of fmpapi is to provide a simple and consistent interface to the Financial Modeling Prep Financial Data API that can be used along side and integrated with other common R resources for collecting and analyzing financial data, such as tidyquant, xts, TTR, and quantmod.

Installation

You can install the latest development version of fmp from Github with:

remotes::install_github('jpiburn/fmpapi')Getting Started

Before getting started with fmpapi you first must obtain an API key for the Financial Modeling Prep Financial Data API. For details, see here.

Once you sign up, you can add your API key to your .Renviron file by using fmp_api_key(). This will add a FMP_API_KEY entry to your .Renviron file so it will automatically be available in future sessions. When first installed however, you will need to reload your .Renviron file by either restarting R or running readRenviron('~/.Renviron')

library(fmpapi)

api_key <- 'my_api_key'

fmp_api_key(api_key)

# reload

readRenviron('~/.Renviron')Company Information and Financials

library(fmpapi)

library(tidyverse)

my_stocks <- c("AAPL", "GE")

d <- fmp_profile(my_stocks)

glimpse(d)

#> Rows: 2

#> Columns: 26

#> $ symbol <chr> "AAPL", "GE"

#> $ price <dbl> 462.25, 6.44

#> $ beta <dbl> 1.228499, 1.177065

#> $ vol_avg <dbl> 36667309, 94472273

#> $ mkt_cap <dbl> 1.976410e+12, 5.637119e+10

#> $ last_div <dbl> 3.18, 0.04

#> $ range <chr> "201.0-464.35", "5.48-13.26"

#> $ changes <dbl> 3.82, -0.03

#> $ company_name <chr> "Apple Inc.", "General Electric Company"

#> $ exchange <chr> "Nasdaq Global Select", "New York Stock Exchange"

#> $ exchange_short_name <chr> "NASDAQ", "NYSE"

#> $ industry <chr> "Consumer Electronics", "Specialty Industrial M...

#> $ website <chr> "http://www.apple.com", "http://www.ge.com"

#> $ description <chr> "Apple Inc. designs, manufactures, and markets ...

#> $ ceo <chr> "Mr. Timothy D. Cook", "Mr. H. Lawrence Culp Jr."

#> $ sector <chr> "Technology", "Industrials"

#> $ country <chr> "United States", "United States"

#> $ full_time_employees <dbl> 137000, 205000

#> $ phone <chr> "408-996-1010", "617-443-3000"

#> $ address <chr> "One Apple Park Way", "5 Necco Street"

#> $ city <chr> "One Apple Park Way", "5 Necco Street"

#> $ state <chr> "CA", "MA"

#> $ zip <chr> "95014", "02210"

#> $ dcf_diff <dbl> 89.92, 21.63

#> $ dcf <dbl> 297.11, 30.90

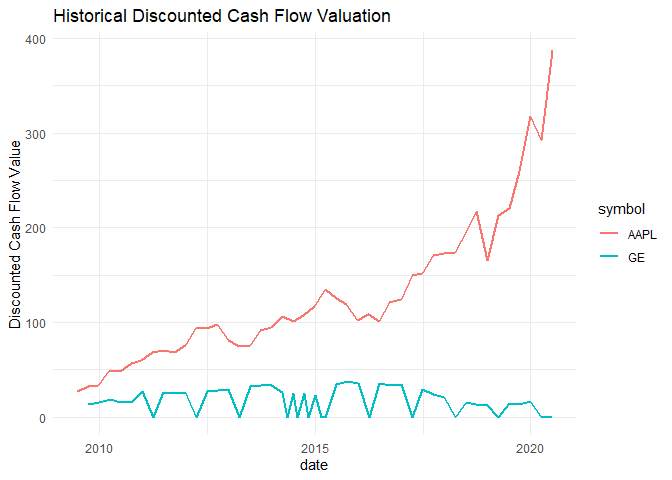

#> $ image <chr> "https://financialmodelingprep.com/image-stock/...Discounted Cash Flow Valuation

fmp_dcf(my_stocks, historical = TRUE, quarterly = TRUE) %>%

ggplot(

aes(x = date, y = dcf, colour = symbol)

) +

geom_line(size = 1) +

theme_minimal() +

labs(

title = "Historical Discounted Cash Flow Valuation",

y = "Discounted Cash Flow Value"

)

Key Metrics

d <- fmp_key_metrics(my_stocks)

glimpse(d)

#> Rows: 73

#> Columns: 59

#> $ symbol <chr> "AAPL", "AAPL", "AAPL",...

#> $ date <date> 2019-09-28, 2018-09-29...

#> $ revenue_per_share <dbl> 55.964480, 53.117842, 4...

#> $ net_income_per_share <dbl> 11.885789216, 11.905940...

#> $ operating_cash_flow_per_share <dbl> 14.92628492, 15.4864624...

#> $ free_cash_flow_per_share <dbl> 12.668767946, 12.823920...

#> $ cash_per_share <dbl> 10.5065421, 5.1824870, ...

#> $ book_value_per_share <dbl> 19.4643350, 21.4289328,...

#> $ tangible_book_value_per_share <dbl> 72.816162, 73.143405, 6...

#> $ shareholders_equity_per_share <dbl> 19.4643350, 21.4289328,...

#> $ interest_debt_per_share <dbl> 21.80359151, 21.7873250...

#> $ market_cap <dbl> 1.157812e+12, 1.061223e...

#> $ enterprise_value <dbl> 1.206755e+12, 1.141009e...

#> $ pe_ratio <dbl> 20.953594, 17.826395, 1...

#> $ price_to_sales_ratio <dbl> 4.4501441, 3.9956442, 3...

#> $ pocfratio <dbl> 16.685331, 13.704873, 1...

#> $ pfcf_ratio <dbl> 19.658581, 16.550321, 1...

#> $ pb_ratio <dbl> 12.795197, 9.904366, 6....

#> $ ptb_ratio <dbl> 12.795197, 9.904366, 6....

#> $ ev_to_sales <dbl> 4.6382605, 4.2960490, 4...

#> $ enterprise_value_over_ebitda <dbl> 14.741690, 13.108117, 1...

#> $ ev_to_operating_cash_flow <dbl> 17.390653, 14.735247, 1...

#> $ ev_to_free_cash_flow <dbl> 20.489588, 17.794625, 1...

#> $ earnings_yield <dbl> 0.047724510, 0.05609659...

#> $ free_cash_flow_yield <dbl> 0.050868372, 0.06042178...

#> $ debt_to_equity <dbl> 2.7410043, 2.4133014, 1...

#> $ debt_to_assets <dbl> 0.7326921, 0.7070285, 0...

#> $ net_debt_to_ebitda <dbl> 0.59788664, 0.91659582,...

#> $ current_ratio <dbl> 1.540126, 1.132926, 1.2...

#> $ interest_coverage <dbl> 18.38283, 22.50093, 27....

#> $ income_quality <dbl> 1.2558093, 1.3007341, 1...

#> $ dividend_yield <dbl> 0.012194555, 0.01292094...

#> $ payout_ratio <dbl> 0.25551976, 0.23033378,...

#> $ sales_general_and_administrative_to_revenue <dbl> 0, 0, 0, 0, 0, 0, 0, 0,...

#> $ research_and_ddevelopement_to_revenue <dbl> 0.06233136, 0.05360041,...

#> $ intangibles_to_total_assets <dbl> 0.00000000, 0.00000000,...

#> $ capex_to_operating_cash_flow <dbl> -6.6118152, -5.8164200,...

#> $ capex_to_revenue <dbl> -24.79028, -19.95005, -...

#> $ capex_to_depreciation <dbl> -1.1955217, -0.8189739,...

#> $ stock_based_compensation_to_revenue <dbl> 0.023322853, 0.02010580...

#> $ graham_number <dbl> 72.1481262, 75.7658298,...

#> $ roic <dbl> 0.28237786, 0.29185015,...

#> $ return_on_tangible_assets <dbl> 0.163230098, 0.16277530...

#> $ graham_net_net <dbl> -27.58139376, -34.58114...

#> $ working_capital <dbl> 5.7101e+10, 1.5410e+10,...

#> $ tangible_asset_value <dbl> NA, NA, 1.26032e+11, 1....

#> $ net_current_asset_value <dbl> -8.52090e+10, -1.27239e...

#> $ invested_capital <dbl> NA, NA, NA, NA, NA, NA,...

#> $ average_receivables <dbl> 23056000000, 2318600000...

#> $ average_payables <dbl> 51062000000, 5588800000...

#> $ average_inventory <dbl> 4031000000, 3956000000,...

#> $ days_sales_outstanding <dbl> 32.16305, 31.86389, 28....

#> $ days_payables_outstanding <dbl> 104.31408, 124.57021, 1...

#> $ days_of_inventory_on_hand <dbl> 9.263639, 8.817631, 12....

#> $ receivables_turnover <dbl> 11.348425, 11.454973, 1...

#> $ payables_turnover <dbl> 3.499048, 2.930074, 3.1...

#> $ inventory_turnover <dbl> 39.401364, 41.394338, 2...

#> $ roe <dbl> 0.610644505, 0.55560118...

#> $ capex_per_share <dbl> -2.257516972, -2.662541...Balance Sheets

d <- fmp_balance_sheet(my_stocks, quarterly = TRUE)

glimpse(d)

#> Rows: 252

#> Columns: 46

#> $ date <date> 2020-06-27, 2020-03-28...

#> $ symbol <chr> "AAPL", "AAPL", "AAPL",...

#> $ filling_date <dttm> 2020-07-31, 2020-05-01...

#> $ accepted_date <dttm> 2020-07-30 19:29:09, 2...

#> $ period <chr> "Q3", "Q2", "Q1", "Q4",...

#> $ cash_and_cash_equivalents <dbl> 3.3383e+10, 4.0174e+10,...

#> $ short_term_investments <dbl> 5.9642e+10, 5.3877e+10,...

#> $ cash_and_short_term_investments <dbl> 9.30250e+10, 9.40510e+1...

#> $ net_receivables <dbl> 1.7882e+10, 1.5722e+10,...

#> $ inventory <dbl> 3.978e+09, 3.334e+09, 4...

#> $ other_current_assets <dbl> 1.0987e+10, 1.5691e+10,...

#> $ total_current_assets <dbl> 1.40065e+11, 1.43753e+1...

#> $ property_plant_equipment_net <dbl> 4.3851e+10, 4.3986e+10,...

#> $ goodwill <dbl> 0.000e+00, 0.000e+00, 0...

#> $ intangible_assets <dbl> 0.000e+00, 0.000e+00, 0...

#> $ goodwill_and_intangible_assets <dbl> 0.000e+00, 0.000e+00, 0...

#> $ long_term_investments <dbl> 1.00592e+11, 9.87930e+1...

#> $ tax_assets <dbl> 0.0000e+00, 0.0000e+00,...

#> $ other_non_current_assets <dbl> 3.2836e+10, 3.3868e+10,...

#> $ total_non_current_assets <dbl> 1.77279e+11, 1.76647e+1...

#> $ other_assets <dbl> 4.3823e+10, 4.9559e+10,...

#> $ total_assets <dbl> 3.17344e+11, 3.20400e+1...

#> $ account_payables <dbl> 3.5325e+10, 3.2421e+10,...

#> $ short_term_debt <dbl> 1.1166e+10, 1.0029e+10,...

#> $ tax_payables <dbl> 0, 0, 0, 0, 0, 0, 0, 0,...

#> $ deferred_revenue <dbl> 6.313e+09, 5.928e+09, 5...

#> $ other_current_liabilities <dbl> 3.9945e+10, 4.2048e+10,...

#> $ total_current_liabilities <dbl> 9.53180e+10, 9.60940e+1...

#> $ long_term_debt <dbl> 9.46780e+10, 8.97150e+1...

#> $ deferred_revenue_non_current <dbl> 0.000e+00, 0.000e+00, 0...

#> $ deferred_tax_liabilities_non_current <dbl> 0.000e+00, 0.000e+00, 0...

#> $ other_non_current_liabilities <dbl> 5.5066e+10, 5.6166e+10,...

#> $ total_non_current_liabilities <dbl> 1.49744e+11, 1.45881e+1...

#> $ other_liabilities <dbl> 5.5066e+10, 5.6166e+10,...

#> $ total_liabilities <dbl> 2.45062e+11, 2.41975e+1...

#> $ common_stock <dbl> 4.8696e+10, 4.8032e+10,...

#> $ retained_earnings <dbl> 2.41360e+10, 3.31820e+1...

#> $ accumulated_other_comprehensive_income_loss <dbl> -6.5230e+10, -6.2854e+1...

#> $ othertotal_stockholders_equity <dbl> -2.163e+09, -1.315e+09,...

#> $ total_stockholders_equity <dbl> 7.22820e+10, 7.84250e+1...

#> $ total_liabilities_and_stockholders_equity <dbl> 3.17344e+11, 3.20400e+1...

#> $ total_investments <dbl> 1.60234e+11, 1.52670e+1...

#> $ total_debt <dbl> 1.13373e+11, 1.10155e+1...

#> $ net_debt <dbl> 79990000000, 6998100000...

#> $ link <chr> "https://www.sec.gov/Ar...

#> $ final_link <chr> "https://www.sec.gov/Ar...Form 13-F Statements

berkshire_cik <- '0001067983'

d <- fmp_13f(berkshire_cik)

glimpse(d)

#> Rows: 50

#> Columns: 12

#> $ date <date> 2020-03-31, 2020-03-31, 2020-03-31, 2020-03-31, 202...

#> $ filling_date <date> 2020-05-15, 2020-05-15, 2020-05-15, 2020-05-15, 202...

#> $ accepted_date <dttm> 2020-05-15 16:06:46, 2020-05-15 16:06:46, 2020-05-1...

#> $ cik <chr> "0001067983", "0001067983", "0001067983", "000106798...

#> $ cusip <chr> "57636Q104", "609207105", "615369105", "674599105", ...

#> $ tickercusip <chr> "MA", "MDLZ", "MCO", "OXY", "PNC", "PG", "RH", "QSR"...

#> $ name_of_issuer <chr> "MASTERCARD INC", "MONDELEZ INTL INC", "MOODYS CORP"...

#> $ shares <dbl> 4934756, 578000, 24669778, 18933054, 9197984, 315400...

#> $ title_of_class <chr> "CL A", "CL A", "COM", "COM", "COM", "COM", "COM", "...

#> $ value <dbl> 1192040000, 28946000, 5217658000, 219245000, 8804310...

#> $ link <chr> "https://www.sec.gov/Archives/edgar/data/1067983/000...

#> $ final_link <chr> "https://www.sec.gov/Archives/edgar/data/1067983/000...Earnings Calendar

d <- fmp_earnings_calendar()

glimpse(d)

#> Rows: 2,861

#> Columns: 3

#> $ symbol <chr> "NOVA", "CHNG", "DGSE", "AMCR", "WMT", "SE", "HMI", "...

#> $ date <dttm> 2020-08-18 00:00:00, 2020-08-18 00:00:00, 2020-08-18...

#> $ eps_estimated <dbl> -0.19, 0.00, 0.00, 0.19, 1.25, -0.42, 0.05, 0.00, -0....SEC RSS Feed

d <- fmp_sec_filings()

glimpse(d)

#> Rows: 1,000

#> Columns: 6

#> $ title <chr> "6-K - Navios South American Logistics Inc. (0001506042) ...

#> $ date <dttm> 2020-08-18 16:46:29, 2020-08-18 16:44:29, 2020-08-18 16:...

#> $ link <chr> "https://www.sec.gov/Archives/edgar/data/1506042/00011931...

#> $ cik <chr> "0001506042", "0001803284", "0001372184", "0000057131", "...

#> $ form_type <chr> "6-K", "10-K", "10-Q", "10-Q", "10-Q", "6-K", "6-K", "10-...

#> $ ticker <chr> "None", "None", "NWYU", "LZB", "AAP", "ALC", "SNDL", "LRC...Quoting Cryptocurrencies

d <- fmp_quote_cryptos()

glimpse(d)

#> Rows: 110

#> Columns: 22

#> $ symbol <chr> "VENUSD", "BLOCKUSD", "MAIDUSD", "GAMEUSD", "...

#> $ name <chr> "VeChain USD", "Blocknet USD", "MaidSafeCoin ...

#> $ price <dbl> 0.11546010, 1.35140470, 0.10211494, 0.0759092...

#> $ changes_percentage <dbl> -4.46, -16.34, -3.29, -3.19, -14.24, 0.00, 6....

#> $ change <dbl> -0.00539107, -0.26389560, -0.00347786, -0.002...

#> $ day_low <dbl> 0.11424368, 1.28605230, 0.10211494, 0.0720481...

#> $ day_high <dbl> 0.12176445, 1.64664470, 0.10807621, 0.0793961...

#> $ year_high <dbl> 0.25831330, 4.37321000, 0.23715703, 0.1187331...

#> $ year_low <dbl> 0.04083622, 0.53095210, 0.03609427, 0.0136530...

#> $ market_cap <dbl> 8270951, 9501057, 46212364, 7526038, 3270747,...

#> $ price_avg50 <dbl> 0.09785710, 1.35970580, 0.10136195, 0.0738029...

#> $ price_avg200 <dbl> 0.08679361, 1.41440920, 0.09546266, 0.0550806...

#> $ volume <dbl> 206088, 22293, 278380, 174828, 102556, 0, 253...

#> $ avg_volume <dbl> 137852, 27533, 243177, 123968, 62513, 93337, ...

#> $ exchange <chr> "CRYPTO", "CRYPTO", "CRYPTO", "CRYPTO", "CRYP...

#> $ open <dbl> 0.12085117, 1.61530030, 0.10559280, 0.0784081...

#> $ previous_close <dbl> 0.12085117, 1.61530030, 0.10559280, 0.0784081...

#> $ eps <dbl> NA, NA, NA, NA, NA, NA, NA, NA, NA, NA, NA, N...

#> $ pe <dbl> NA, NA, NA, NA, NA, NA, NA, NA, NA, NA, NA, N...

#> $ earnings_announcement <dbl> NA, NA, NA, NA, NA, NA, NA, NA, NA, NA, NA, N...

#> $ shares_outstanding <dbl> 71634712, 7030505, 452552428, 99145190, 97259...

#> $ timestamp <dbl> 1597783638, 1597783638, 1597783638, 159778363...